The First 100 Days in 8 Charts

The first 100 days of the new administration have been…eventful. Many of the 2025 forecasts published last December have been cast aside. Companies are starting to report first quarter earnings, and many are opting to forego any forward-looking guidance. The near-term future seems too uncertain. Markets have been volatile, but there have been some bright spots. Here are eight charts that hopefully provide some perspective around these first 100 days.

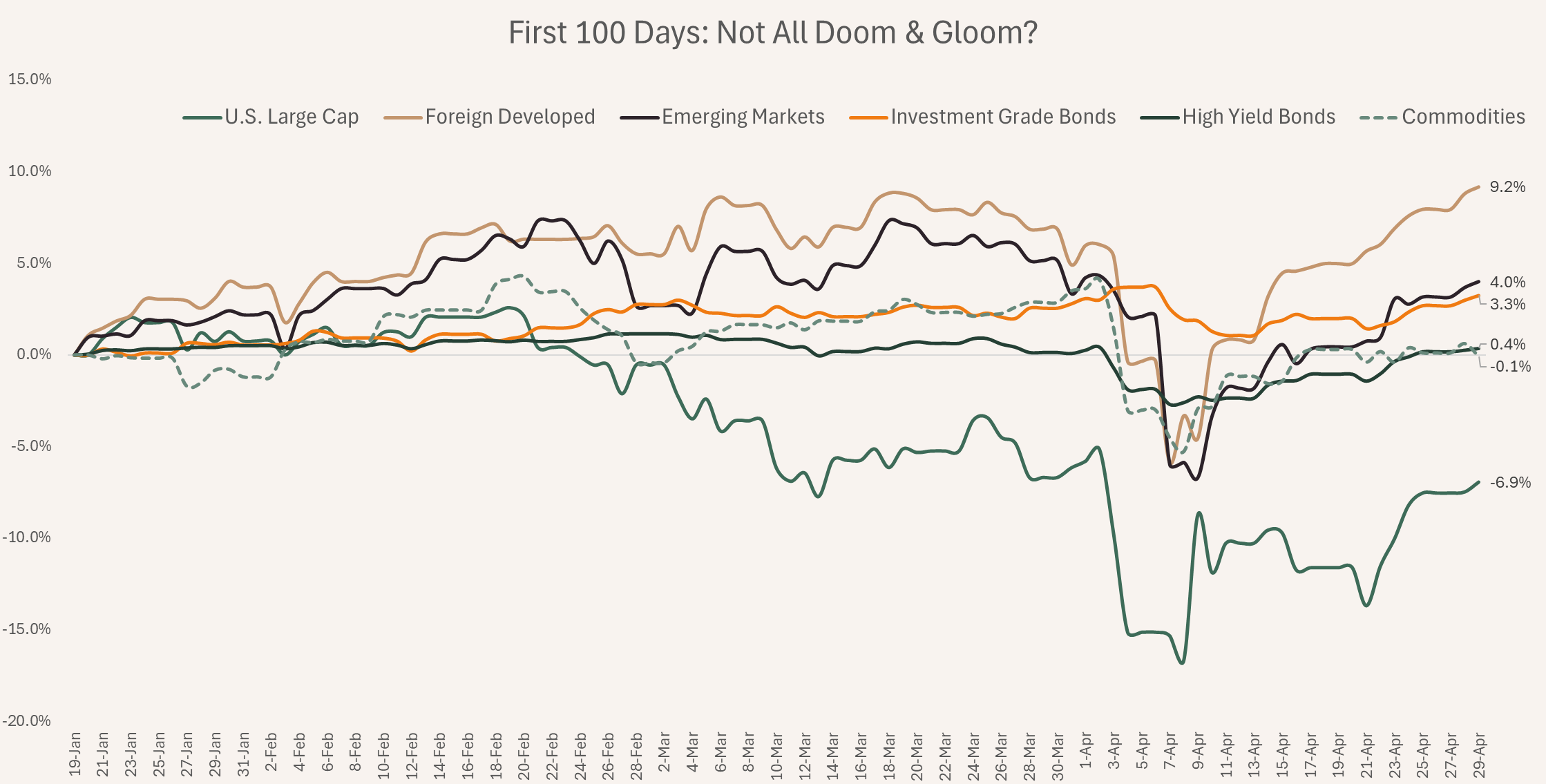

U.S. stocks are down, but diversification has helped!

After falling nearly 20% from their highs, U.S. large cap stocks have rebounded and are now down about 7% since January 20th, including dividends. Foreign stocks and investment grade bonds have helped. They have returned 9.2% and 3.3%, respectively.

How tariffs and other policy initiatives evolve from here could lead to wildly different outcomes. Broader global exposure to stocks and bonds seems reasonable for those wanting to diversify risks.

Source: Divvi Wealth Management, Morningstar Direct. U.S. Large Cap represented by S&P 500. Foreign Developed represented by MSCI World. Emerging Markets represented by MSCI Emerging Markets. Investment Grade Bonds represented by Bloomberg U.S. Aggregate Bond Index. High Yield Bonds represented by ICE BofA U.S. High Yield Index. Commodities represented by Bloomberg U.S. Commodities Index. Past performance does not guarantee future results.

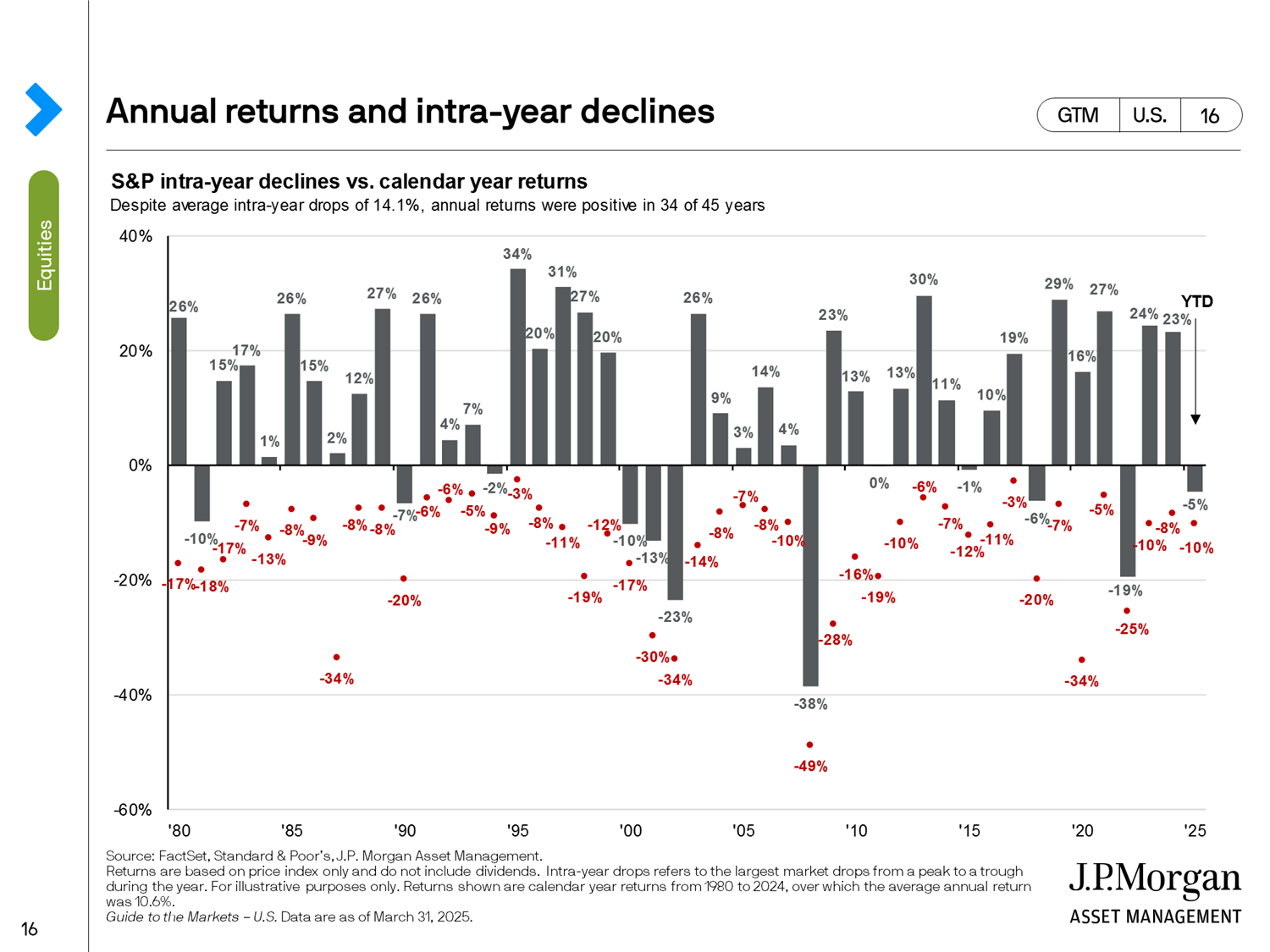

Stock prices fall often

Equity drawdowns are common. The chart below from J.P. Morgan shows the average intra-year decline since 1980 is about 14%. The market has usually recovered, reminding investors that volatility is part of the journey.

Source: J.P. Morgan

Magnificent 7 Stocks Struggle.

As a group, the “Magnificent 7” stocks – Apple, Microsoft, NVIDIA, Alphabet, Meta, Amazon.com, and Tesla – had a fantastic 2024, returning over 60%. These companies are some of the biggest in the world, and they fueled the S&P 500’s 25% return last year. The equal-weighted index, which owns exactly the same stocks as the S&P 500, just in an equal proportion, returned just 13% in 2024.

2025 has been a different story. The Magnificent 7 stocks are down about 16% in the first 100 days, while the equal-weighted S&P 500 is down just 5.7%.

Source: Divvi Wealth Management, Morningstar Direct. Mag 7 Equal Weight includes Apple, Microsoft, Amazon.com, Meta, Alphabet, NVIDIA, and Tesla.

The value of the U.S. dollar has been declining.

One of the big stories of the first 100 days has been the falling dollar. For most of the last 15 years, the dollar has been gaining strength. A strong dollar acts as a headwind for U.S. investors owning foreign investments. Dollar-based investors get a “boost” in their foreign investments when those foreign currencies appreciate against the dollar. The last meaningful period of foreign stock outperformance was the mid-2000s. Should the dollar continue to lose value to foreign currencies, broader global diversification in investment portfolios could be beneficial for the first time in a long time.

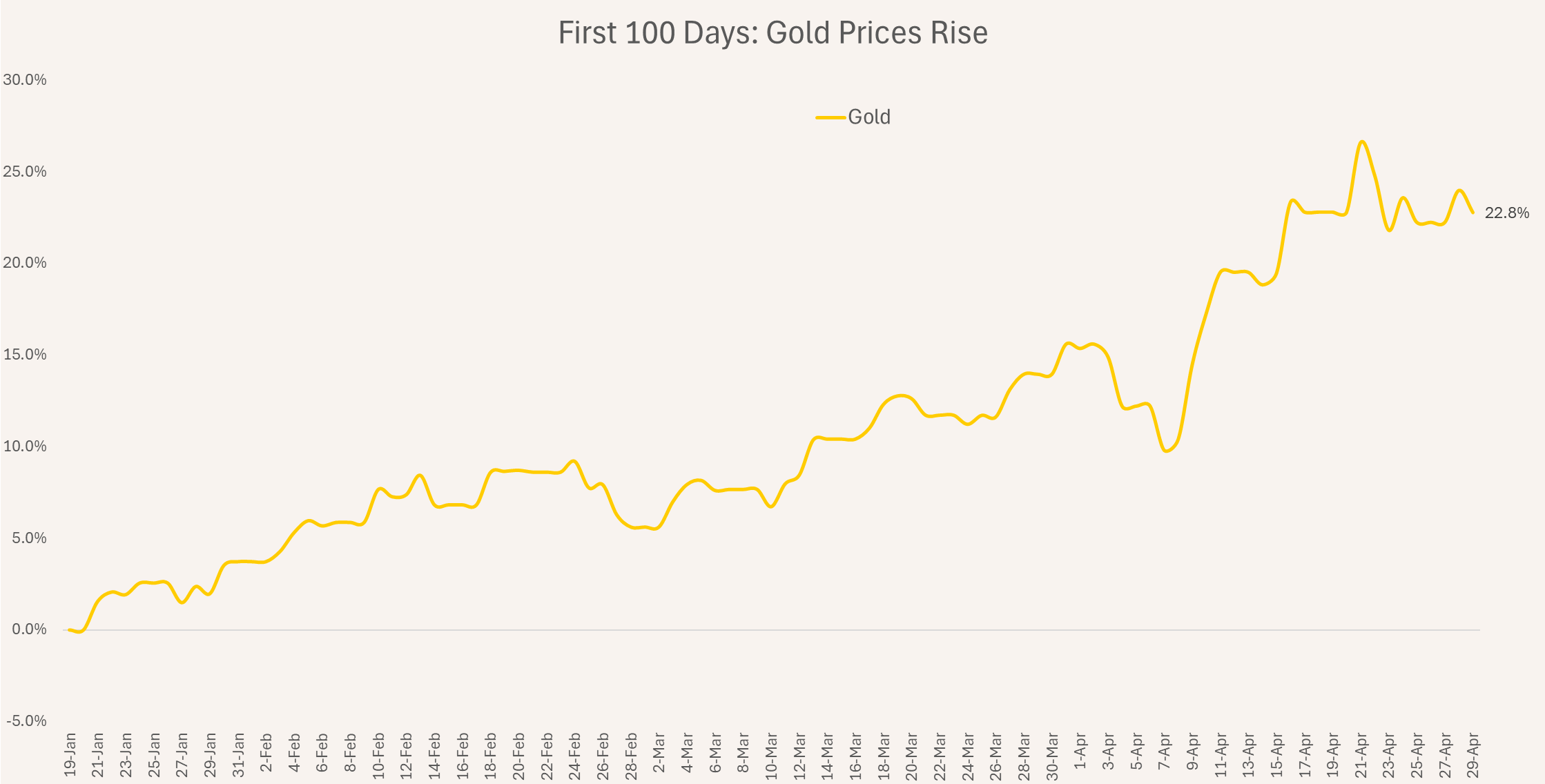

Meanwhile, gold has been on a tear.

Gold has been very strong since January 20th. It is often seen as a safe-haven asset, frequently performing well in times of market stress and extreme uncertainty. The SPDR Gold ETF (SPDR) rose over 20% in the first 100 days of the new administration.

Source: Divvi Wealth Management, Morningstar Direct. Gold represented by the SPDR Gold Trust ETF (GLD).

Markets expect more rate cuts in 2025.

Expectations for rate cuts have been shifting meaningfully. On January 20th, the odds of the Fed cutting the fed funds rate by at least 100 basis points were slim. Now, it’s basically a coin flip.

The Fed has a dual mandate: support full employment and keep inflation low. If tariffs push prices higher while the economy softens, the Fed could be in a very tough position. Cutting rates to stimulate economic growth could stoke inflation. On the other hand, keeping rates level (or even raising rates) to combat higher prices would likely put more pressure on the economy.

This will be one of the more interesting stories to watch unfold through the rest of 2025.

Source: CME Group

Stocks are (maybe) cheaper

Valuations for U.S. stocks have fallen since the beginning of the year. The forward P/E ratio for the S&P 500 has fallen from 22x to around 19x. That may feel more reasonable, unless these earnings estimates turn out to be too rosy, in which case valuations may fall further. Regardless of the direction in the short-term, keeping a disciplined, diversified strategy may be one of the more reliable ways to remain focused on the long-term.

Source: Yardeni. The numerator of the P/E ratio is the level of the S&P 500 Index, and the denominator is consensus earnings forecasts from analysts.

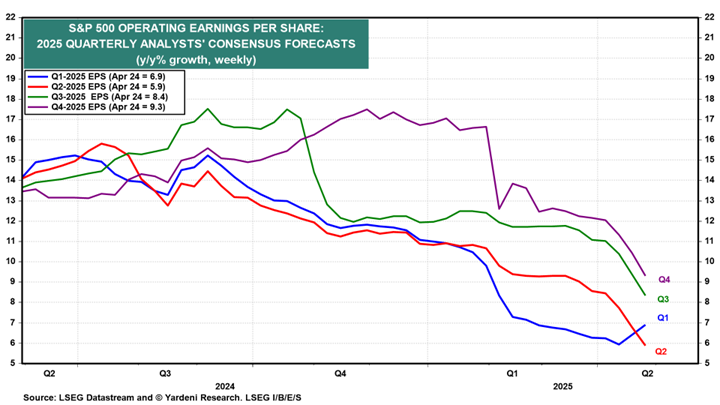

Earnings expectations have fallen

Analysts have been cutting 2025 earnings expectations for a couple of quarters now. The market may remain volatile as these estimates continue to adjust to new information about tariffs, tax policy, geopolitics, etc. If this disruption ends up being short-term in nature, investors may quickly revise these and future earnings estimates upward, potentially setting the table for a better environment for stocks.

Volatility tends to cluster in periods of uncertainty. Staying committed to a long-term plan can help avoid missing the big up days that often occur around the big down days.

Source: Yardeni

Summary

The first 100 days of this administration have brought both challenges and opportunities for investors. Surprises are inevitable. While policy shifts and volatility can test conviction, we believe they also reinforce the value of a long-term plan that accounts for an individual’s unique risk preferences and financial goals.

Divvi Wealth Management (DWM) is a State of Missouri registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. DWM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. DWM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to the adviser’s ADV Part 2A for material risks disclosures.

Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. DWM has presented information in a fair and balanced manner.

DWM is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.

DWM may discuss and display, charts, graphs and formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions, and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.