Recession Predictions: Noise or Necessity?

Fear and greed are two powerful emotions, and news stories highlighting a potential recession are common. The Wall Street Journal recently published an article titled, To Gen Z, Everything Is a Recession Indicator. I clicked, of course.

The odds of a recession in 2025 on Polymarket, a prediction market where people can bet on outcomes of specific events, jumped since the beginning of the year from 20% to about 65% on April 6. Trade policy and potential tariffs are the most obvious reasons. Recently, the U.S. and China appeared to make progress on the trade front. Recession odds fell in response. J.P. Morgan lowered recession odds to below 50%, Goldman Sachs lowered their odds from 45% to 35%, and betters on Polymarket are placing the odds at about 40%.

Predicting the next recession is a tough game, and one I’d prefer not to play. It may be a bit more interesting and useful to look at past recessions and their impact on investors.

Not all recessions are created equal

Since 1947, the US economy has weathered 12 recessions. The worst, and shortest, was during the COVID pandemic, when Global Domestic Product (GDP) abruptly fell more than 9%. Fortunately, global pandemics are not too common.

Looking at the other periods, the average drop in GDP during the previous 11 recessions was 2.2%. The drop in output during the 2008 Global Financial Crisis was the worst of the bunch at 4%. Since the two most recent recessions were the most severe in terms of GDP declines, it may lead us to assume the next recession will be extreme, too. But in nearly half of the previous 11 recessions, excluding the COVID recession, GDP fell less than 2%.

Source: Divvi Wealth Management, Federal Reserve Bank of St. Louis via FRED.

Recessions: Less frequent, but not obsolete

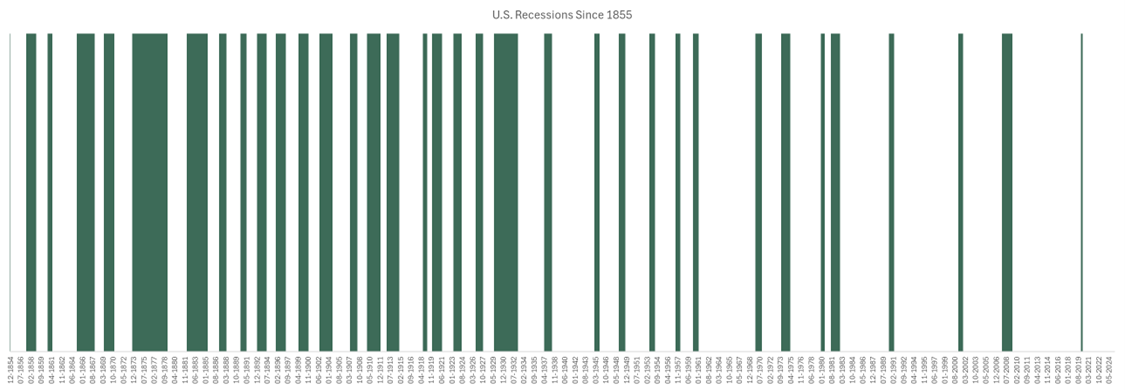

Recessions just haven’t been as common in recent years. The green shaded areas represent periods when the U.S. was in a recession. Recessions were quite common from 1850 through the 1930s. As our economy has matured, and policy makers have learned from previous missteps, recessions have been less frequent.

NBER based Recession Indicators. Source: Federal Reserve Bank of St. Louis via FRED.

A more resilient economy (but still vulnerable)

Speaking of our economy maturing, the makeup has shifted dramatically over the last 75 years. About three-quarters of the output in the U.S. is now service-based. In 1950, more than half of our economic output was goods-based. Having a consumption-based economy does not make us immune to periods of slow or negative growth, but it may influence our expansions to be a bit longer, and the downturns to be somewhat less frequent.

Source: Bureau of Economic Analysis (BEA), Divvi Wealth Management

Stocks usually bottom before recessions end

Investors tend to look forward, both in stock and bond markets. The first chart below shows S&P 500 peak-to-trough drawdowns, using quarterly data. Markets often begin falling before recessions begin, and they often start to recover before the recessions end. The second chart shows credit spreads. Think of credit spreads like a price tag for risk. Investors demand a higher return (or spread) when the economy is shakier than normal. Spreads tend to widen ahead of recessions as investors begin to price tougher economic conditions.

Finally, sometimes markets fall and spreads widen with no recession in sight! The reasons often seem obvious in hindsight. But seeing these sharp drops – and recoveries – in advance is easier said than done.

Source: Divvi Wealth Management, Morningstar Direct, Federal Reserve Bank of St. Louis via FRED. Past performance does not guarantee future results.

Calls for recession are common

Last month, Jamie Dimon – the highly-respected CEO of J.P. Morgan – made headlines when he said a recession in the US was a “likely outcome.” When he speaks, people usually listen. But a quick Google search shows these type of recession forecasts are not new.

This may seem like I’m picking on Jamie Dimon. I am not. To be fair, he didn’t say a recession is a certainty, and we may still slip into a recession this year. My point is simpler: recessions are very difficult to predict, even for those with incredible resources and experience.

Was Dimon right last month to suggest a recession was likely? It sure seemed plausible when tariffs were causing extreme amounts of fear. Now in mid-May, the temperature has changed quite a bit. Tariffs are on pause (for the moment), the stock market has recovered most of its losses, and some people seem more concerned about a new Air Force One than the economy.

Optimists have been rewarded over the long-run

Through all the recessions, U.S. stocks have been a good long-term investment. The data in the chart below goes back to 1936, or about nine decades. The trend for nearly a century has been up and to the right. Of course, past performance does not guarantee future results.

Disruptions happen and should be expected. Through all of the economic slowdowns, stocks in the U.S. have historically rewarded patient investors with greater wealth and purchasing power.

Source: Divvi Wealth Management, Morningstar Direct, Federal Reserve Bank of St. Louis via FRED. Past performance does not guarantee future results.

Long-term investing principles don’t need to change

I’m generally not a proponent of making big changes to long-term investment strategies based on economic forecasts.

I think the principles of sound long-term investing didn’t change with the tariff announcements from earlier this year. Diversify. Keep costs low. Invest systematically and consistently. Align your portfolio with your time horizon. Prioritize after-tax returns. Avoid making short-term decisions based on emotion. I still believe simple things like this will serve investors well over the long term.

Summary

Recessions are an inevitable part of our economic past, and our future. Each has its own story. They remain challenging to predict, but understanding their historical impact may help avoid common emotional pitfalls that often arise during a downturn.

Divvi Wealth Management (DWM) is a State of Missouri registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. DWM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. DWM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to the adviser’s ADV Part 2A for material risks disclosures.

Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. DWM has presented information in a fair and balanced manner.

DWM is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.

DWM may discuss and display, charts, graphs and formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions, and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.