The Best Investments from 2023

It’s that time of year. We look back and kick ourselves for not predicting what now, in hindsight, seems so obvious. (Keep an eye out for an annual letter, which will be sent next week.)

***NOTE: we plan to share more thoughts via video and YouTube in 2024. Please click here to subscribe so you don’t miss anything, and scroll to the bottom of the page if you’d prefer to watch this update instead of reading.

Every once in a while, we feel the need to be less serious and write about something that is purely entertaining (well, for us nerds, anyway). This post should be treated as such. Pure entertainment. Nothing actionable. Absolutely no advice. To that end, here are the best investments of 2023.

We looked at this from a few different angles, but there are certainly other reasonable methods of measuring “best” that I don’t include, and the list is not exhaustive. So if you own something that performed better than what I mention below, congrats! I didn’t leave it off the list intentionally. I promise.

Without further adieu, here are the best investments of last year.

Morningstar CATEGORY

Morningstar groups mutual funds and ETFs into categories. At last count, I have 112 categories. All but five categories had positive returns last year!

Here are the top 5 categories of 2023, and the group’s total return:

Digital Assets: 155%

Technology: 43%

Large Growth: 37%

Latin America Stock: 31%

Consumer Cyclical: 30%

The Digital Assets category only includes 59 unique funds, but it is a reflection of the strong rally in cryptocurrencies last year. The price of Bitcoin - the largest token by market capitalization - surged over 150% last year.

The average Large Growth fund had over 50% of assets invested in the technology and consumer cyclical sets, so it’s no surprise to see all three listed here considering they own many of the same companies.

The Latin America Stock category is tiny, both in terms of funds (13) and assets ($9 billion). Take a sneak peak at the country chart below. Seeing Brazil and Mexico among last year’s top performers helps explain why this category cracked the top 5, too.

COUNTRIES

Returns of iShares country ETFs and the S&P 500 to represent the United States.

You didn’t own a bunch of Polish, Mexican, and Taiwanese companies last year? Me, neither! And unless you live in those countries (home country bias is strong! WSJ discusses more here), the answer is almost certainly, “no!” The Poland ETF (EPOL), for example, only owns 31 companies and over ⅔ of the assets are in 10 stocks!

Looking at single country returns is good for entertainment value, and little else. Many of these ETFs are similar to EPOL mentioned above - highly concentrated in a few companies or sectors, and have tiny trading volumes compared to places like the U.S.

S&P 500

The top five performing stocks in the S&P 500 from 2023 saw their share prices rise anywhere from 129% to 239% during the year!

The S&P 500 is often used as a proxy for “the market.” How did the market do, you ask? There’s a decent chance the first return I quote is that of the S&P 500. It’s roughly 500 of the biggest, publicly traded companies in the United States.

You may have heard the term, “Magnificent 7,” referring to Microsoft, Apple, NVIDIA, Amazon.com, Meta, Tesla, and Google parent Alphabet. As a group, they were responsible for about 60% of the S&P 500’s total return last year. But only two were among the best performers. Here are the five companies from the S&P 500 with the best returns last year:

Artificial Intelligence (AI) went mainstream last year and isn’t turning back. Demand for NVIDIA’s chips pushed its stock price higher by 239%, making it the biggest S&P 500 winner.

Meta, which owns Facebook, Instagram, Messenger, and What’sApp, nearly tripled (!!) during the year!

Cruise ships were cool last year! Royal Caribbean and Carnival had stellar years.

Homebuilders including PulteGroup saw share prices move much higher as well. Higher mortgage rates reduced the number of existing homes that hit the market, and homebuilders/new construction accounted for an increasingly large portion of supply.

Final note: nothing goes up all the time, even the best-performing stocks! Each of these had companies had meaningful drawdowns during the year. It’s normal.

BONDS

Bond returns rebounded in 2023 as well, with below investment grade corporate and municipal bonds leading the pack.

Most bonds are generally going to be more sensitive to changes in interest rates or credit. Credit was the big winner last year, which is no surprise (in hindsight, again) considering the strength of the economy and stock prices. Corporate bonds are typically highly correlated with stocks, meaning they tend to move in the same direction.

Below investment grade bonds (i.e. high yield) returned over 13% for the year

High yield municipal bonds had strong performance as well, returning 9.2%

Corporate bonds (see comments about ‘credit’ above) were up about 8.5%

long-term reminder

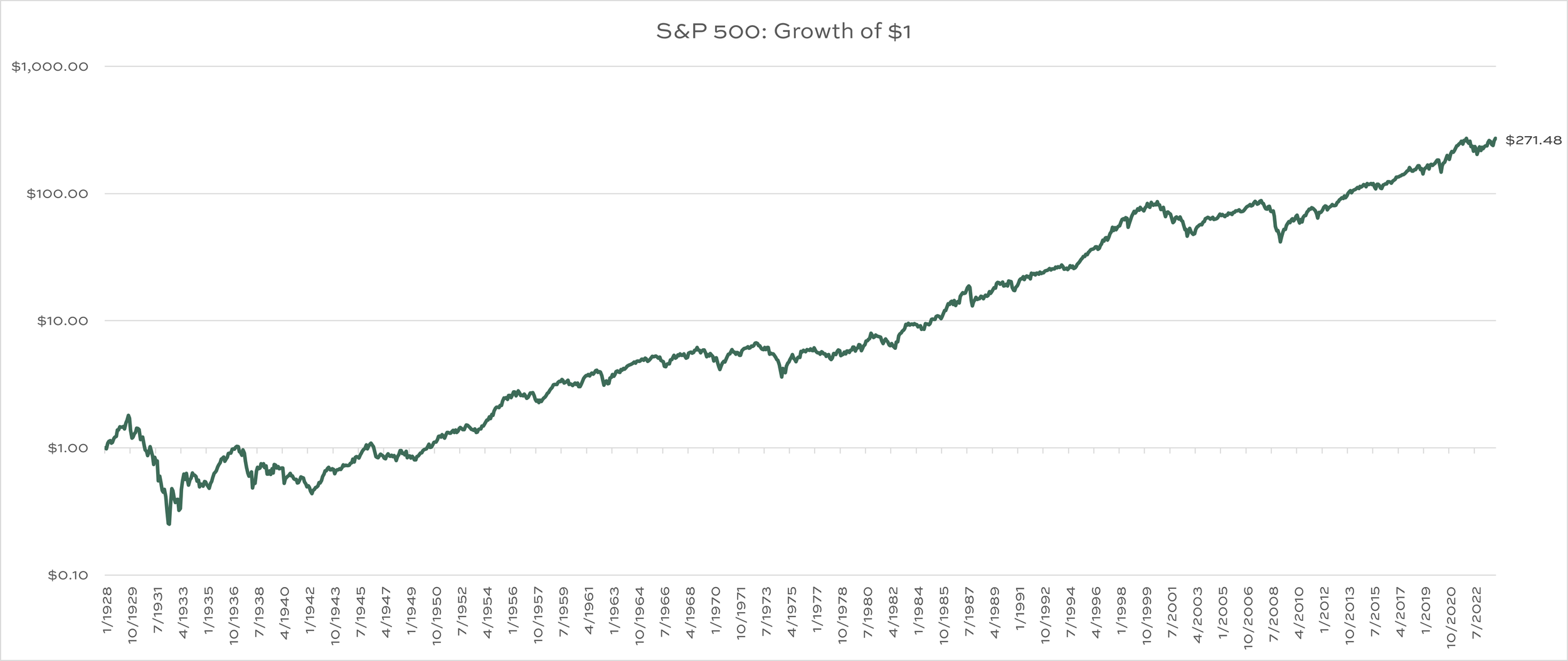

While we’re on the topic of “best” investments, I’ll wrap with this chart. It isn’t from the past year, but it might be on the only chart in this post that means anything for long-term investors. It shows the growth of $1 invested in the S&P 500 since 1928.

It’s easy for us to get wrapped up in the short-term ups and downs. But if your time horizon allows for it, zoom out. The long-term trend in this chart is overwhelmingly positive. Patience has been rewarded!

Growth of $1 invested in the S&P 500 since 1928. Price only; does not include dividends.

summary

2023 was a pretty good year for investors! And it was a great year for anyone that owned something mentioned above. I have fun looking back, evaluating what performed well, and why.

If it were only that easy to pick this year’s winners! Forecasting is tough - we wrote about that a little last year and NYT highlights the notoriously bad track record of those predicting annual stock returns. Will last year’s best investments repeat in 2024? Stay tuned and I’ll be happy to tell you next January! It’s worth noting few of the investments mentioned above would have been on a similar “Best of 2022” list. In fact:

3 of the top 5 Morningstar categories were in 2022’s bottom 5: Digital Assets (-66%), Technology (-37%), and Consumer Cyclical (-34%)

Taiwan and Poland were two of the worst five performing country ETFs in 2022, down 29% and 25%, respectively.

None of the top 5 S&P 500 companies were repeats from 2022. Meta (-64%) and Carnival (-60%) were in the bottom 12, however.

As long as accurate forecasting remains challenging, we continue to be fans of diversifying risks, owning quality, and sticking to a plan!

Happy New Year!

Want to know what investments delivered the best returns last year? In this video, Eric with Divvi discusses some of 2023's top performing Morningstar categories, countries, stocks, and bonds, including a few that may surprise you!

Divvi Wealth Management (DWM) is a State registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. DWM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. DWM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to the adviser’s ADV Part 2A for material risks disclosures.

Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. DWM has presented information in a fair and balanced manner.

DWM is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.

DWM may discuss and display, charts, graphs and formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions, and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.