Turning 50? It May Be Time to Catch Up

Hitting 50 is a milestone birthday. It’s the year the tax code lets you put a little extra “oomph” behind your retirement savings. Below is a guide to contribution rules for 2026 and a few coordination tips that may help.

What changes at 50

You’re eligible for some “catch-up” contributions the entire calendar year you turn 50. Even if your birthday is late in the year, you can make these catch-ups all year long. Here are some deferral and catch-up contribution details for 2026.

401(k), 403(b), governmental 457(b), and the federal Thrift Savings Plan (TSP): Base deferral of $24,500 plus standard catch-up of $8,000. There’s also a special age 60–63 catch-up of $11,250, which replaces the standard catch-up, if your plan adopts it. Total employee deferrals could potentially reach $35,750 in those years.

IRAs (Traditional and Roth combined): Base $7,500 plus a $1,100 catch-up (total of $8,600 if 50+). Income limits still determine Roth eligibility and Traditional IRA deductibility.

SIMPLE IRA/401(k): Base $17,000 plus a standard catch-up of $4,000 (most SIMPLE plans); a 60–63 catch-up of $5,250 is newly available where plans adopt it.

Health Savings Accounts (HSAs) are a bit different. They do allow catch-up contributions ($1,000), but not until age 55. Keep this on the radar for the mid-50s.

| Account type | Base 2026 employee limit |

Age-50 catch-up |

Notes |

|---|---|---|---|

| 401(k) / 403(b) / TSP | $24,500 | $8,000 | “Super” catch-up for ages 60–63: $11,250 if plan allows. |

| 457(b) (governmental) | $24,500 | $8,000 | Separate special 3-year catch-up near retirement may allow up to double the deferral limit if you have unused prior-year deferrals (plan permitting). |

| SIMPLE IRA/401(k)* | $17,000 | $4,000 | Ages 60–63 “super” catch-up: $5,250 if plan allows. |

| IRA (Traditional + Roth total) | $7,500 | $1,100 | Income limits apply for Roth contributions and Traditional IRA deductions. |

Important coordination rules

403(b) 15-year service catch-up

Some long-tenured employees of schools, hospitals, certain non-profits, and churches can contribute up to $3,000 extra per year, up to a lifetime maximum of $15,000, before the age-50 catch-up is applied. If your plan offers both, the 15-year catch-up is used first, then the age-50 catch-up on top.

457(b) special catch-up in the last three years before normal retirement age

Governmental 457(b) plans may let you double the annual deferral limit using prior-year “unused” amounts during the final three years before the plan’s stated retirement age. You can’t use the age-50 catch-up and the special 457(b) catch-up in the same year—your plan will apply whichever gives you the higher limit.

Total contribution caps still apply

Catch-ups don’t count toward the overall defined contribution annual addition cap ($72,000 in 2026), but employer contributions and after-tax dollars do. IRS

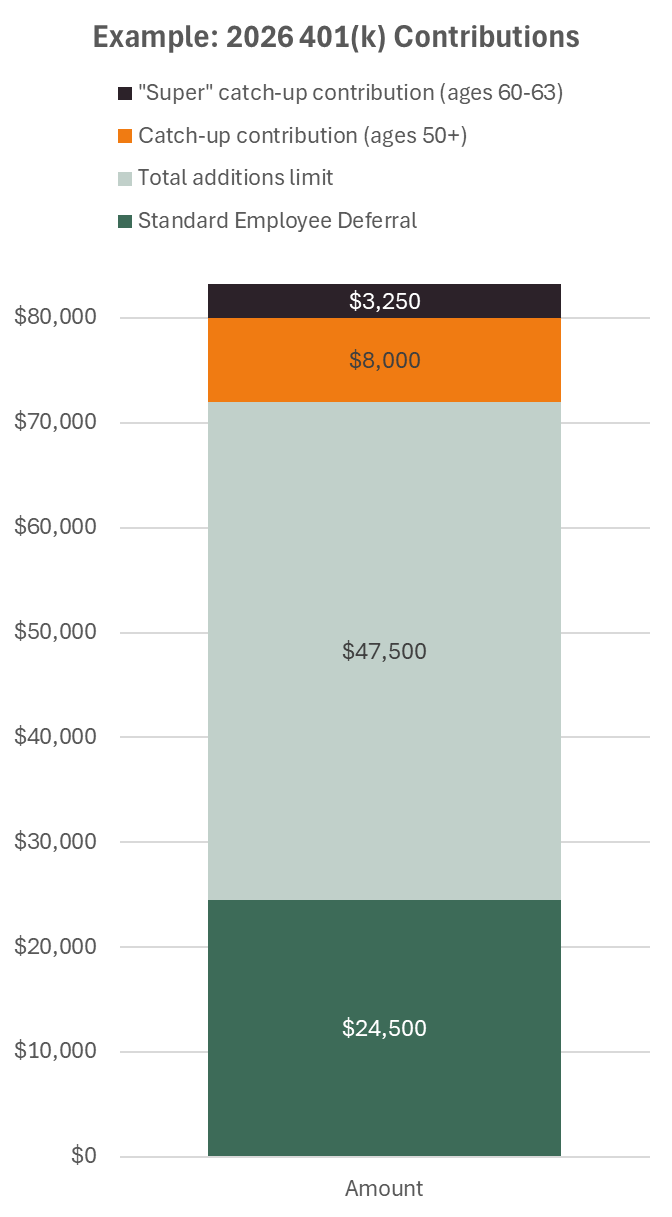

For example, a 50-year old 401(k) participant could potentially contribute the following in 2026:

Maximum 401(k) salary deferrals: $24,500

Maximum employer contributions: $47,500 (the difference between the $72,000 annual additions cap and employee salary deferrals. Employer contributions are subject to plan provisions and employer discretion.)

Catch-up contribution: $8,000

And a 60-year old could make the “super” catch-up contribution of $11,250 ($3,250 more than the standard catch-up), if their plan allows.

Heads-up for higher earners: Roth-only catch-ups are coming

Roth-only catch-ups for certain higher-income employees are expected to be required beginning in 2026. The wage threshold used to test 2026 catch‑ups is $150,000 of prior‑year (2025) wages.

Practical ways to use your new “catch-up”

Automate now. If your 50th birthday is later in 2026, you can still raise deferrals at the beginning of the year. Eligibility is based on reaching 50 years old by December 31. Payroll systems don’t always do this for you.

Front-load vs. pace-yourself. If your plan matches per pay period, consider spreading contributions across the year to avoid missing match dollars. Matching formulas vary by plan.

Coordinate across plans. The $24,500 employee deferral limit (and catch-up) is shared across all 401(k)/403(b) plans you contribute to in a year. Be sure to track totals if you changed jobs mid-year. 457(b) plans have a separate limit.

Be aware of the “super” windows. From 60–63, some plans let you use the higher catch-up ($11,250 for 401(k)/403(b)/TSP; $5,250 for SIMPLE). Confirm what your plan allows.

Layer IRAs on top of retirement plan contributions. If income allows, consider adding an IRA (or nondeductible IRA contribution and Roth conversion, where appropriate) to capture the extra $1,100 catch-up contribution.

Bottom line

Age 50 opens meaningful new ways to accelerate savings at the same time many are in peak earning years. Contact us if you would like to discuss how catch-up contributions could impact your situation in more detail.

This material is for informational purposes only and is not intended as tax, legal, or individualized investment advice. Contribution limits and tax rules are based on federal law in effect for the 2026 tax year and may change. How these rules apply to you will depend on your specific situation. Before making contribution or tax decisions, consult with your tax professional and review your employer’s plan documents. Divvi Wealth Management is a registered investment adviser. Registration does not imply a certain level of skill or training. Numbers and rules in this guide reflect federal law and IRS guidance as of November 2025.

Divvi Wealth Management (“DWM”) is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. This content is for educational, general-interest purposes only and is intended for a broad audience; it is not individualized advice and should not be construed as a recommendation to buy or sell any security or to adopt any investment strategy. Investments involve risk, including the possible loss of principal.

DWM believes this communication is fair and balanced and does not contain any untrue statement of material fact or omit material facts necessary to avoid being misleading. We do not present performance in a manner that would create a misleading implication and we do not state or imply that the SEC has reviewed or approved any performance or presentation.

Any references to past market performance or historical trends are not a guarantee of future results. If performance information is ever presented, it will be shown with appropriate net-of-fee comparisons and required time periods, consistent with the SEC’s Marketing Rule; otherwise, DWM may elect not to present performance at all.

DWM does not provide tax, legal, or accounting advice. You should consult your professional advisors on these matters.

Charts, graphs, or formulas shown are tools to illustrate concepts and are not by themselves sufficient to determine which securities or strategies are appropriate for you.

If testimonials, endorsements, or third-party ratings appear in any DWM materials, we will provide clear, prominent disclosures of whether the speaker is a client, whether compensation was provided, any material conflicts, and key details about any third-party rating. DWM does not compensate any “ineligible person” for testimonials or endorsements.

For more information about DWM’s services, fees, and important disclosures, please review our Form ADV Part 2A (Firm Brochure) and, for retail investors, our Form CRS (Client Relationship Summary). We provide these documents to prospective clients and make updated versions available upon request.

DWM’s social-media and website content may be considered “advertising” under SEC rules; static content is reviewed in advance pursuant to our internal Advertising and Social Media policies.