After the 401(k), Where to Invest Next?

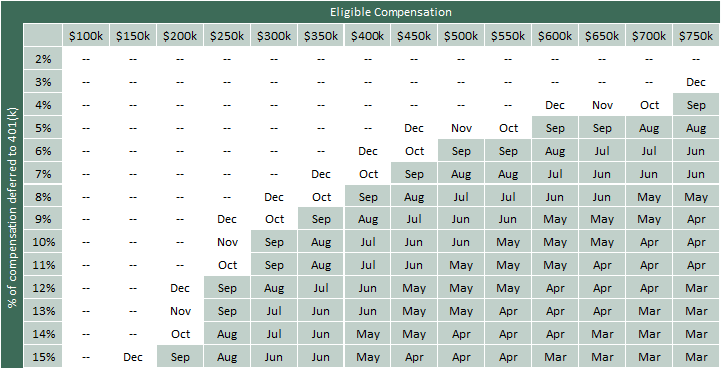

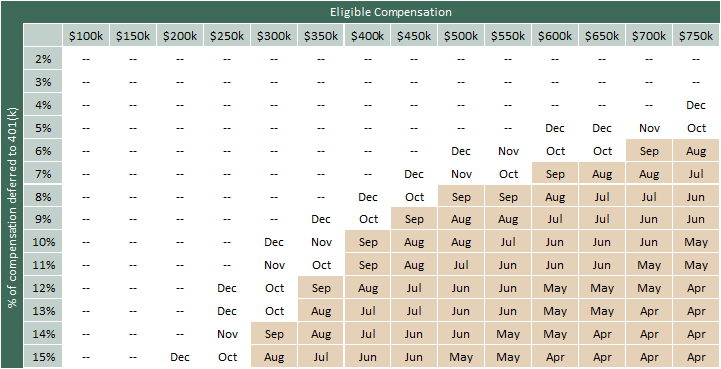

When will you max out your annual 401(k) contributions? Use the first table below to see what month the $22,500 deferral limit is reached for employees under 50 years old. Scroll to the right (the table with brown shading) if you’re over age 50 and eligible for the $7,500 additional catch-up contribution. All months September or earlier are shaded.

For example, if you are 40 years old, make $300,000, and contribute 10% to your 401(k), you are about to cross that maximum annual contribution line. Are you a high-income individual making $500,000 who contributes 8%? You reached the limit in July.

[Prefer video? Scroll to the bottom to watch.]

Some investors prefer to max out the 401(k), either with pre-tax contributions or after-tax Roth contributions. Others contribute just enough to take full advantage of an employer match. And for many others, the answer is somewhere in between.

Regardless of how that question is answered, people often wonder where to go next. What makes the most sense after 401(k) contributions are finished for the year? Let’s look at a few options, specifically through the lens of tax treatment, availability, and flexibility.

Taxable brokerage account

Taxes

Income and gains from taxable brokerage accounts are taxed in the year realized. Sold some shares of a stock this year for a big gain? Unless you realized some offsetting losses (more on this in a minute), expect to pay capital gains tax next April. The same is true for interest income from investments like bonds and CDs. That interest will be taxed as ordinary income, which for many high-income families, can eat up 40% or more of your returns.

Certain investments and strategies can, at worst, give investors control over the timing and nature of taxes (now vs. later, and ordinary income vs. capital gain). At best, they may significantly improve long-term after-tax returns. An example of this is direct indexing, which you can learn more about here, if interested. If long-term tax-efficient growth is the goal, exchange traded funds (ETFs) – either indexed or actively managed – can be a great option for taxable brokerage accounts, too.

Availability

If you’re reading this, odds are excellent you can open a brokerage accounts. While some accounts require the owner to have earned income, or income below certain limits, the brokerage account can be funded with assets from virtually any (legal) source.

Flexibility

The ultimate in flexibility, assets held in a brokerage account can fund any goal you choose, without restrictions or penalties. Need to fund a downpayment on a house? No problem. Is a child’s spring tuition due? Can do. A big part of their appeal is the ability to customize the investment plan to the investor, too.

IRA – traditional or Roth

After employer-sponsored plans like 401(k)s, Individual Retirement Accounts, or IRAs, are one of the most commonly used tools to help investors save for retirement. They come in a few flavors, and we’ll briefly touch on the traditional IRA and the Roth IRA.

Taxes

Starting with traditional IRAs, contributions may be tax-deductible. Here are the rules from the IRS. If you and your spouse (if you’re married) are not covered by a company retirement plan, you can deduct the full contribution. Income limits apply if you and/or your spouse have access to a retirement plan at work.

Distributions from traditional IRAs are usually taxed as ordinary income. Not sure of your tax bracket? Click here for the full breakdown from the IRS. If your contribution didn’t qualify for a deduction, then that percentage of the distribution is not taxable. Divide non-deductible contributions by the account balance to determine the non-taxable ratio.

One of the few improvements on “free” is “tax-free.” While contributions are not tax-deductible, distributions from Roth IRAs can be completely tax-free as long as a few basic qualifications are met. Click here for a flowchart that can help.

Availability

Anyone with taxable compensation can contribute to a traditional IRA. The limit is the lesser of that taxable comp or $6,500. Those age 50 or older qualify for an additional $1,000 catch-up contribution, too. Remember, these contributions may be tax-deductible based on the rules mentioned above.

Roth IRAs are a bit different. To contribute directly to a Roth, income needs to be below certain thresholds. Click here to see the breakdown from the IRS. Is your income too high to make Roth contributions? A conversion strategy (aka backdoor Roth) could still be an option. We wrote about this strategy earlier this summer, if you’re interested in how this works.

Flexibility

If you like rules, IRAs are for you! Especially when it comes to “qualified” distributions. Here are a few considerations for IRA owners.

Investments: most investment types are fair game, except for life insurance and collectibles. Be careful before investing in collectibles, as those dollars may be considered “distributed” and trigger tax and penalty.

Distributions: understand the rules here. These are spelled out in IRS publication 590 B in detail, and here are a few highlights. The “R” in IRA stands for retirement, so these should be considered long-term commitments. Wait until age 59.5 to avoid a 10% penalty for both traditional and Roth IRAs. Owners of traditional IRAs will be required to take distributions (RMDs) in their early 70s, depending on when they were born. Assets in Roth IRAs, however, can stay in the account throughout the owner’s lifetime.

Annuities

Yes, annuities are an option. And for those who are interested in tax deferral, they may be a good option at a reasonable price. Just be aware of the costs, restrictions, and eventual tax treatment of distributions. Many annuities charge high fees and may include terms that restrict you from withdrawing money or charge hefty penalties to do so.

Taxes

Taxation of annuities, regardless of their type, is fairly straightforward. Assets held inside annuities grow tax deferred and once withdrawn, any growth will be treated as ordinary income, while contributions will be tax-free return of capital. If the annuity is owned inside an IRA, all distributions will be treated as ordinary income.

Availability

Virtually anyone can buy an annuity with after-tax dollars, with few limitations. And annuity buyers should have plenty of choices. A quick search in Morningstar Direct shows over 3,000 different variable annuity products from which to choose. Other flavors like fixed annuities or indexed annuities are also options. However, for those primarily concerned with long-term growth and tax deferral, these seem less appealing to me.

Flexibility

From an investment perspective, pay attention to the individual contract details. Some annuities offer a wide variety of investment options, including low-cost index funds and reasonably priced active managers. Others may be very limited.

Again, if long-term growth and tax deferral are the main goals, weigh the pros and cons against those from the taxable brokerage account. I think the potential for better tax treatment (capital gain vs. ordinary income), tax efficient growth (ETFs or direct indexing can give investors considerable control over the timing of tax liabilities), and optionality (use the money whenever, wherever you want) give the taxable brokerage account an advantage in many situations.

Summary

Many high-income savers, or those that just save a substantial percentage of their income, will face a decision in the fall. Continue saving outside the 401(k), or just wait to start over next year? For those who choose to keep saving, take some time to understand the options available to you. The choices outlined above are just three of many. Each come with their own pros and cons, features and benefits.

Divvi Wealth Management (DWM) is a State registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. DWM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. DWM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to the adviser’s ADV Part 2A for material risks disclosures.

Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. DWM has presented information in a fair and balanced manner.

DWM is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.

DWM may discuss and display, charts, graphs and formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions, and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.